The Basic Principles Of Baron Tax & Accounting

The Basic Principles Of Baron Tax & Accounting

Blog Article

The Basic Principles Of Baron Tax & Accounting

Table of ContentsThe Ultimate Guide To Baron Tax & AccountingBaron Tax & Accounting - TruthsIndicators on Baron Tax & Accounting You Need To Know3 Simple Techniques For Baron Tax & AccountingGetting The Baron Tax & Accounting To Work

And also, bookkeepers are expected to have a decent understanding of maths and have some experience in a management function. To become an accounting professional, you have to contend least a bachelor's degree or, for a greater degree of authority and expertise, you can come to be a public accounting professional. Accounting professionals need to likewise meet the rigorous needs of the accountancy code of practice.

This ensures Australian service owners obtain the best feasible financial suggestions and management feasible. Throughout this blog site, we have actually highlighted the huge differences between accountants and accountants, from training, to duties within your service.

Some Of Baron Tax & Accounting

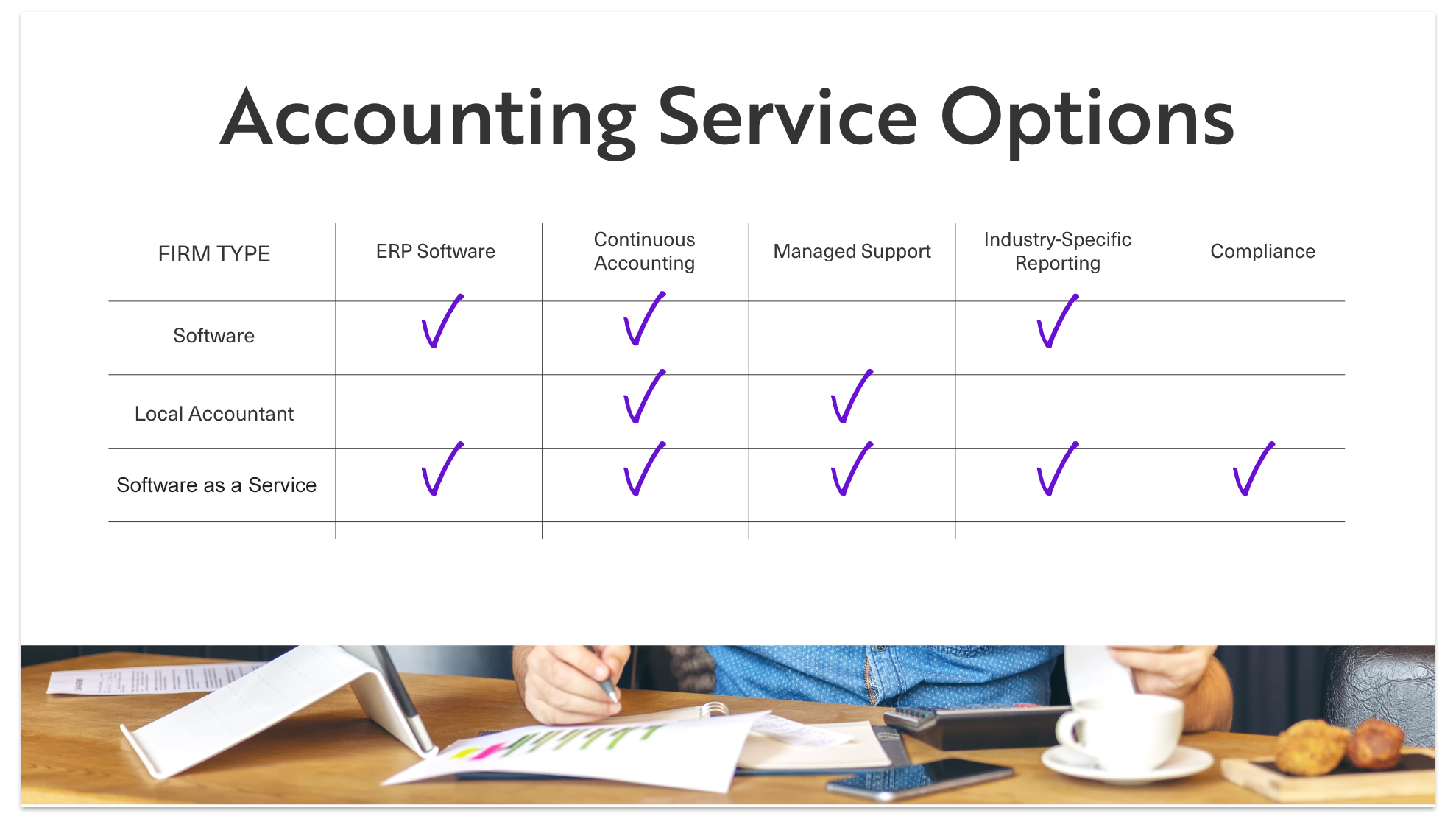

Accountancy firms do even more than just accounting. The services they supply can maximize profits and support your funds. Companies and individuals ought to take into consideration accountants a critical component of monetary planning. No audit company supplies every service, so guarantee your experts are best matched to your particular demands (trusted online tax agent). Recognizing where to start is the first hurdle

Accounting professionals additionally can suggest customers on making tax obligation law benefit them. All taxpayers have the right to representation, according to the internal revenue service. Bookkeeping firms can assist businesses represent their interests with assessment for filing treatments, info requests, and audits. The majority of firms don't work alone to accomplish these responses. They work along with lawyers, economic coordinators, and insurance coverage professionals to produce a strategy to lower taxi payments and prevent costly blunders.

(https://www.slideshare.net/jacobbernier4000)

Accountants are there to compute and update the collection amount of cash every employee gets consistently. Keep in mind that vacations and illness impact payroll, so it's an aspect of the service that you have to regularly update. Retirement is likewise a considerable element of payroll administration, especially provided that not every staff member will wish to be enlisted or be eligible for your business's retirement matching.

Things about Baron Tax & Accounting

Some lenders and investors call for decisive, critical choices between the business and investors complying with the meeting. Accounting professionals can likewise be present below to aid in the decision-making process.

Tiny services commonly deal with distinct financial difficulties, which is where accountants can offer indispensable assistance. Accounting professionals offer a series of services that assist businesses remain on top of their finances and make notified choices. Accounting professionals additionally make certain that organizations abide by financial policies, taking full advantage of tax obligation savings and reducing mistakes in financial documents.

Therefore, expert bookkeeping helps prevent pricey blunders. Payroll administration includes the administration of worker incomes and salaries, tax deductions, and advantages. Accountants ensure that employees are paid properly and on schedule. They determine payroll taxes, take care of withholdings, and ensure conformity with governmental laws. Handling paychecks Handling tax obligation filings and repayments Tracking staff member advantages and reductions Preparing payroll reports Correct pay-roll monitoring avoids problems such as late payments, wrong tax filings, and non-compliance with labor legislations.

7 Simple Techniques For Baron Tax & Accounting

Tiny company proprietors can rely on their accountants to take care of complex tax codes and laws, making the filing process smoother and much more effective. Tax obligation planning is another vital solution provided by accountants.

Accounting professionals help little services in figuring out the worth of the business. Methods like,, and are used. Accurate evaluation aids with offering the service, protecting finances, or attracting capitalists.

Guide service owners on best techniques. Audit assistance assists companies go with audits efficiently and successfully. It minimizes stress and mistakes, making sure that services meet all essential policies.

By establishing reasonable economic targets, companies can allot resources successfully. Accountants overview in the execution of these techniques to guarantee they align with the organization's vision. straight from the source They frequently evaluate strategies to adapt to transforming market conditions or organization growth. Danger management involves recognizing, examining, and mitigating threats that could affect a company.

Some Known Details About Baron Tax & Accounting

They guarantee that services adhere to tax obligation legislations and industry laws to prevent penalties. Accounting professionals also advise insurance coverage policies that use protection versus potential threats, making sure the business is guarded against unexpected occasions.

These tools help local business maintain precise documents and improve procedures. is praised for its extensive features. It assists with invoicing, pay-roll, and tax preparation. For a free choice, is advised. It provides several features at no expense and appropriates for start-ups and local business. stands apart for convenience of usage.

Report this page